Category Archives: Finance

Are you thinking about becoming a landlord?

At Jersey Cape Realty, we often get questions from prospective buyers about what is involved in being a landlord. With so many homes in Cape May being  investment/rental homes, this is a huge consideration when thinking about purchasing. Renting a home to vacationers can provide a solid income to offset mortgage, tax, utility, insurance and maintenance bills. The key, however, is to make sure you are prepared to handle the rental business.

investment/rental homes, this is a huge consideration when thinking about purchasing. Renting a home to vacationers can provide a solid income to offset mortgage, tax, utility, insurance and maintenance bills. The key, however, is to make sure you are prepared to handle the rental business.

First and foremost, you need to ask yourself if you can bear to have someone using your house. You must be able to walk away and allow your guests to enjoy their time at your home without interruption. Think of what made you feel most welcome the last time you vacationed and try to recreate that good feeling for your tenants.

In considering furnishings and amenities, a good rule of thumb is to equip the home with all the necessary comforts but do not leave anything in the home that you absolutely couldn’t live without or that has extreme sentimental value. Accidents happen and you wouldn’t want that favorite item to get damaged. Landlords will often set aside a closet where they can lock away special items.

It is always good to know what the local ordinances and requirements are for vac ation rentals. As the owner, you want to make sure you are in compliance with all requirements for legal and safety issues.

ation rentals. As the owner, you want to make sure you are in compliance with all requirements for legal and safety issues.

Another consideration is how close your primary residence is to the rental property. Are you within a short drive in case of emergency? What about regular maintenance? If you are planning to handle that yourself, you will want to consider the distance and time spent traveling back and forth.

It is good to think about how vacation rentals are transacted. How will you attract tenants to your home? How will you best position the property for the highest visibility in the rental market? Once tenants are interested, how will you screen them? How will you finalize the rental, collect rent and security deposits? How will you take care of check-in, check-out and any tenant emergencies? You may want to be involved in the process or totally hands off.

If this sounds like a lot of work, the perfect solution would be to call Jersey Cape Realty! The Rental Team as Jersey Cape Realty has worked with many landlords over the years. Everyone has to start somewhere and the professional rental agents at Jersey Cape Realty are happy to take the time to review the entire rental business with new landlords. The Jersey Cape Realty Rental Team consists of full time Realtors dedicated solely to the rental business. They work day in and day out to maximize your rentals and be the welcoming voice for your tenants, answering questions ranging from availability and rent amounts to where to get a good burger or the cost of beach tags.

In addition, the Jersey Cape Realty Rental Team will market your property, both online and in print, to attract tenants. They will prepare leases and circulate them for signature to formalize rentals. Jersey Cape Realty will handle all rental accounting for you, including security deposit collection and disbursement. Your tenants will check-in and check-out at the Jersey Cape Realty office (curbside service in summer) which frees you from that responsibility. The Jersey Cape Realty Rental Team will provide your tenants with an emergency contact number for 24/7 coverage. Jersey Cape Realty will be happy to help coordinate any maintenance or repair issues, and can provide suggestions for local workmen to save you from traveling. This is just a sampling of what the Jersey Cape Realty Rental Team can do for you. If you have any questions about becoming a landlord, please contact the qualified, experienced agents at Jersey Cape Realty, 609-884-5800. The Jersey Cape Realty Rental Team looks forward to helping you and your guests.

If you have any questions about becoming a landlord, please contact the qualified, experienced agents at Jersey Cape Realty, 609-884-5800. The Jersey Cape Realty Rental Team looks forward to helping you and your guests.

Spring has Sprung! Jersey Cape’s real estate market update..

As we write this, it is still winter but the Spring buying market is upon us! New construction is booming with high demand. Savvy buyers are coming into the market to lock in lower interest rates now, as indicators point to higher rates later this year. Available listings are trending lower than the demand, meaning it’s a great time for sellers to get into the market.

New construction is booming with high demand. Savvy buyers are coming into the market to lock in lower interest rates now, as indicators point to higher rates later this year. Available listings are trending lower than the demand, meaning it’s a great time for sellers to get into the market.

A look at the current market shows us that:

Cape May currently has 44 single family residential homes available, with the lowest price at $292,000 and the highest at $5,695.000. The median price (half are above and half are below) is $891,500. Cape May Point offers 15 residential homes, with a low price of $475,000, a high of $2,499,900 and the median being $695,000. West Cape May has 23 single family homes for sale with the lowest starting at $280,000, the highest at $999,000, and the median at $699,000.

Let’s take a look at sales for the beginning of 2017. From January 1 through February 15, Cape May had 13 single family residential homes sell. The lowest sold price was $570,000 while the highest sold price was $2,750,000. The median sold price was $799,000. In West Cape May, 7 homes have sold with a low selling price of $365,000 and a high of $653,000. The median West Cape May price was $425,000. There are no reported single family residential home sales yet for Cape May Point this year.

Let’s take a look at sales for the beginning of 2017. From January 1 through February 15, Cape May had 13 single family residential homes sell. The lowest sold price was $570,000 while the highest sold price was $2,750,000. The median sold price was $799,000. In West Cape May, 7 homes have sold with a low selling price of $365,000 and a high of $653,000. The median West Cape May price was $425,000. There are no reported single family residential home sales yet for Cape May Point this year.

Regarding residential homes under contract right now, there are 18, with 7 in Cape May, 3 in Cape May Point, and 8 in West Cape May. The average sale price for those under contract is $725,816.

While the market offers some nice buying opportunities, there is certainly room for more listings as the Spring market heats up with pent up demand. Jersey Cape Realty can help! If you are thinking of selling, give us a call today for a no obligation market analysis on your home. If you are considering buying, we’d be happy to discuss the current options with you. Call or email today, 609-884-5800.

How to Shave a Down Payment….

Is a down payment stopping you from buying your first home or maybe that second home at t he shore? Are you thinking that you have to have 20% or more to put down? What if you could find financing with somewhere between 0 and 10% down? It can happen! The good news is that there are many options available to home buyers today. Jersey Cape Realty agents work with a number of reputable lenders who would be happy to discuss all the financing options that might fit your personal scenario.

he shore? Are you thinking that you have to have 20% or more to put down? What if you could find financing with somewhere between 0 and 10% down? It can happen! The good news is that there are many options available to home buyers today. Jersey Cape Realty agents work with a number of reputable lenders who would be happy to discuss all the financing options that might fit your personal scenario.

Let’s take look at a couple of home buyers’ situations:

Suppose Tom wants to buy his first home. He looked online and then viewed his favorites with his Jersey Cape Realty agent to hone in on the perfect house. It is priced at $200,000. A traditional 20% down payment would be $40,000, plus Tom would need closing costs on top of that. (More about closing costs later.) Tom has worked hard to save $30,000, but he’s still short. No deal, right? No so! Tom’s agent put him in touch with a few reputable local lending experts. They reviewed Tom’s employment history, credit history, and finances and then suggested various mortgage opportunities available with a smaller down payment. As it turns out, Tom is actively serving the country in the military. He is able to take advantage of a VA loan, with 100% financing and an interest rate currently hovering around 3%. Now if Tom wasn’t in the military, he might have qualified for an FHA mortgage, with a down payment of 3.5%, or $7000, and an interest rate currently around 3%. Pretty good, right?

Let’s look at another example:

Suppose Nancy wants to buy a second home at the shore for her family to enjoy. Nancy looked at homes with her Jersey Cape Realty agent and found the perfect home about three blocks to the beach, priced at $600,000. A 20% down payment would be $120,000. Nancy would like to find a way to put less down so she can keep the cash available for redecorating and furnishing the new house. After consulting with a few local lending experts, Nancy decided on an 80-10-10 mortgage program. The way it works is that there is a first mortgage for 80%, originated simultaneously with a second mortgage for 10%, and then Nancy puts down the remaining 10%, or $60,000, in cash. This is often called a piggy back mortgage. The second mortgage may be an equity line of credit on either the current home or the new home. Another possibility for Nancy if she didn’t want to do the 80-10-10, could be to pull the equity out of her primary home for all of the 20% down payment and just get an 80% mortgage on the second home. This keeps all of Nancy’s cash available for refurbishing the new home. It all depends on Nancy’s particular financial qualifications. Lenders are happy to review all of the possibilities and make suggestions.

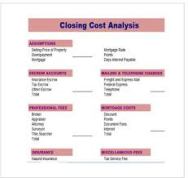

Closing costs were mentioned above. Buyers and sellers each have costs associated with closing. These are in addition to the down payment or earnest money deposit. Closing costs inclu de things like title insurance, various inspections, repairs, homeowner’s insurance, utility and tax adjustments, etc. Your Jersey Cape Realty agent and lender will estimate these costs for you up front. Sometimes sellers will offer to pay certain closing costs for a buyer as an incentive and sometimes costs are negotiated in the agreement of sale.

de things like title insurance, various inspections, repairs, homeowner’s insurance, utility and tax adjustments, etc. Your Jersey Cape Realty agent and lender will estimate these costs for you up front. Sometimes sellers will offer to pay certain closing costs for a buyer as an incentive and sometimes costs are negotiated in the agreement of sale.

Whatever your financial situation, contact the knowledgeable agents at Jersey Cape Realty today. They will be happy to provide names of reputable local lenders for you to call and figure what type of mortgage might fit your needs. With this information predetermined, you will know exactly how much house you can afford. Don’t wait. Rates are expected to increase over the next year so now is the right time to get started.

Jersey Cape Realty is available 7 days a week at 609-884-5800. Search sale properties online www.jerseycaperealty.com.